Resolution 2021-005 was adopted at the most recent Soldotna City Council meeting.

It is a resolution that adopted an alternate allocation method for the Fiscal Year 2021 shared fisheries business tax program and certifying that this allocation method fairly represents the distribution of significant effects of fisheries business activity in the Fisheries Management Area 14: Cook Inlet Area.

According to Soldotna City Manager, Stephanie Queen, the purpose of the Shared Fisheries Business Tax Program is to provide for an annual sharing of State fish tax collected outside municipal boundaries, with municipalities that have been affected by fishing industry activities. In order to participate in the Shared Fisheries Business Tax Program, each municipality within a Fisheries Management Area (FMA) is required to complete Shared Fisheries Business Tax Application annually and include a resolution adopted by the municipality’s governing body.

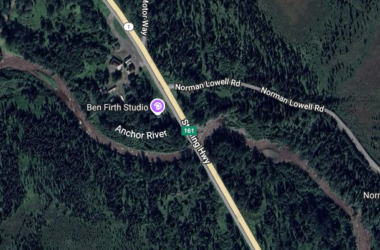

The City of Soldotna is part of the FMA 14: Cook Inlet Fisheries Management Area; which includes the Municipality of Anchorage, Matanuska-Susitna Borough, Houston, Palmer, Wasilla, Homer, Kenai, Kenai Peninsula Borough, Kachemak, Seldovia, Seward and Soldotna.

According to Queen, the State distributes 50% of the fish tax collected outside municipal boundaries equally among the municipalities within the FMA and the remaining 50% is split based on an allocation method agreed upon by all municipalities within the FMA. The state allows two allocation methods: the Standard Method, where each municipality must determine and document the cost of fisheries business impacts experienced in 2019 or the Alternative Method, where all municipalities within the FMA must unanimously agree to jointly use an alternative method approved by the State. If all municipalities within the FMA do not unanimously agree, each municipality within the FMA must use the Standard method. Currently every FMA in the State that is required to complete a “long form” application (FMAs receiving more than 4,000) uses the Alternative method. The 50% share impacted by this allocation method, to be allocated amongst 12 municipalities, totals $4,175.86 in FY21.

Each year, the Cook Inlet FMA uses the Alternative Method and bases the allocation on population. The proposed resolution has been updated and will be adopted by each of the 12 municipalities within the Cook Inlet FMA.

The resolution became effective upon its adoption.