Alaska has experienced a dramatic rise in commercial construction spending over the past five years, with statewide totals increasing by more than 75% since 2018 according to a recent report. In 2023 alone, Alaska reported $618 million in private nonresidential construction activity—an increase of 44.7% after adjusting for inflation.

Researchers at a Texas-based construction aggregate supplier, Twisted Nail, analyzed national and state-level data from the U.S. Census Bureau.

Per capita, Alaska invested $843 per resident in commercial projects last year. While not among the top states in the nation, the figure is significant given the state’s declining population and economic headwinds in recent years. The construction growth signals a renewed focus on industrial development, infrastructure, and logistics across Alaska.

The trend follows a national pattern. Commercial construction across the U.S. dipped sharply during the early months of the COVID-19 pandemic, as uncertainty stalled projects and office demand plummeted. But by late 2021, the tide began to turn. Investment rebounded, fueled by a return to in-person activity and historic federal infrastructure and manufacturing incentives. By early 2025, total U.S. commercial construction spending reached more than $740 billion—the highest in two decades.

Key sectors leading that rebound include manufacturing, warehouse development, and logistics infrastructure. Manufacturing alone has more than doubled since 2019, driven by domestic production incentives and supply chain restructuring. Health care and food-related projects are also seeing moderate growth.

However, not all sectors are sharing equally in the upswing. Office construction remains down by over 10% nationwide, while lodging has declined by more than 40% as travel patterns and remote work continue to reshape demand. Those same pressures are being felt in Alaska, where development has shifted away from speculative commercial projects and toward critical infrastructure, transportation hubs, and industrial needs.

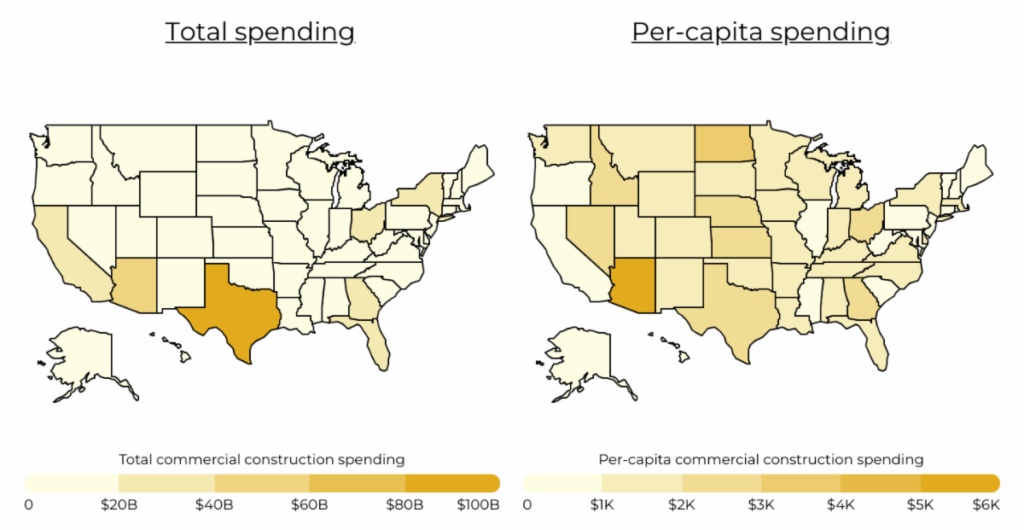

While larger states like Texas and California lead the nation in total dollars spent, several smaller and rural states—including Alaska—are seeing rapid percentage growth. This reflects a broader shift in national construction activity toward regions with strategic assets, abundant land, and growing demand for resilient logistics networks.

The future of commercial construction in Alaska will depend on multiple factors. Federal funding from recent infrastructure and manufacturing legislation continues to flow into project development across the state. At the same time, inflation, tariffs, and supply chain constraints could impact timelines and budgets for upcoming builds.

Still, the data suggests Alaska is well-positioned to benefit from national economic trends. Strategic investments in freight corridors, energy projects, and industrial facilities are likely to continue driving growth. And with the state’s construction sector already gaining momentum, Alaska appears to be entering a new chapter of commercial development—one defined by long-term infrastructure needs and regional economic resilience.