The Kenai Peninsula Borough Assembly passed a resolution opposing a statewide sales tax. The Alaska State Legislature is currently considering a statewide sales tax, an income tax, and other revenue measures as part of a long-term fiscal plan.

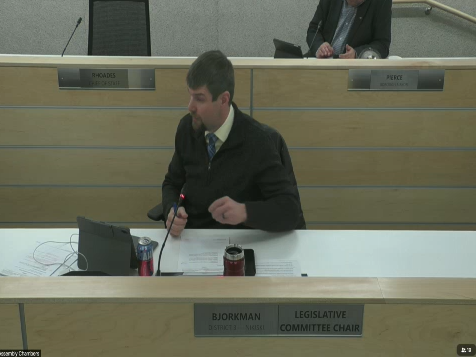

Assembly Member Jesse Bjorkman said:

“The concern I have with this resolution specifically is every legislator that I have talked to from our Borough has said that if new revenue is needed that they would support a sales tax. The resolution that we’re considering here tonight opposes any sales tax. It doesn’t just oppose parts of the sales tax that would take away local control. It doesn’t oppose ideas inside of a sales tax piece of legislation that would eliminate one exemption or another. What we heard in committee was a lot of conjecture about what might happen and what we’re being asked to do through this resolution is eliminate a tool that state legislators might use to bring about a fiscal plan for the state. That’s not something that I’m comfortable doing especially considering that we have some conservative legislators from our borough that have said if revenue is necessary then they would support a sales tax. I certainly don’t want to take that away from them or encourage them not to use a tool that they would like to use by resolution.”

The resolution states that the State of Alaska continues to shift the financial burden for the provision of government services, including education, to local municipalities, which have long funded local government services by imposing local sales taxes carefully tailored to meet the needs of local residents and economies. A statewide sales tax combined with existing local sales taxes, according to the KPB, will eventually result in communities reducing local sales tax rates and increasing local property tax rates to continue delivering essential municipal services.

According to Borough code, net proceeds from collected sales tax is only used for borough school purposes. As a result of increased administration and collections costs, which will decrease tax revenue, a statewide sales tax will negatively impact funding for the Kenai Peninsula Borough School District.

The resolution passed on a 5-4 vote.